Trust Foundation Honesty: Structure Count On Every Project

Enhance Your Legacy With Professional Trust Fund Foundation Solutions

In the world of legacy preparation, the significance of developing a strong structure can not be overemphasized. Specialist depend on structure solutions provide a durable framework that can protect your properties and guarantee your wishes are lugged out exactly as intended. From lessening tax obligation liabilities to picking a trustee who can effectively manage your affairs, there are critical factors to consider that require attention. The complexities entailed in trust frameworks necessitate a critical approach that aligns with your long-term objectives and values (trust foundations). As we look into the subtleties of depend on foundation services, we uncover the crucial elements that can fortify your legacy and provide an enduring effect for generations to come.

Advantages of Depend On Structure Solutions

Trust fund foundation solutions provide a robust framework for protecting assets and guaranteeing long-term financial security for people and organizations alike. One of the main advantages of trust fund foundation services is possession defense.

Furthermore, trust structure options offer a strategic strategy to estate preparation. With trusts, individuals can describe exactly how their properties should be managed and dispersed upon their passing away. This not only assists to prevent disputes amongst beneficiaries however likewise makes sure that the individual's heritage is maintained and managed properly. Trust funds also supply privacy benefits, as possessions held within a trust fund are not subject to probate, which is a public and frequently extensive legal process.

Kinds Of Depends On for Tradition Planning

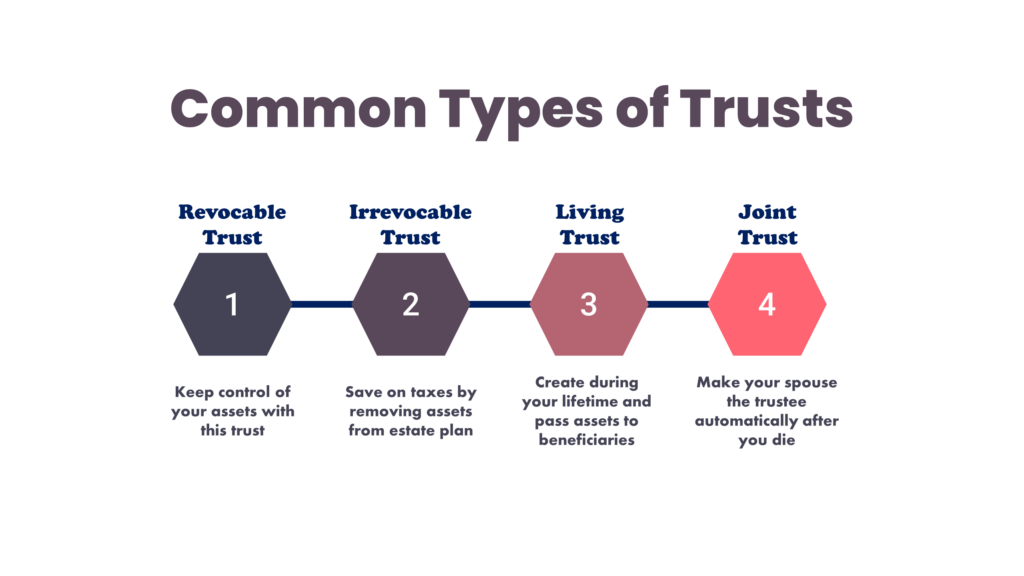

When taking into consideration tradition preparation, a critical element entails discovering various kinds of legal tools made to preserve and disperse assets effectively. One common kind of trust fund used in heritage preparation is a revocable living trust fund. This trust permits individuals to preserve control over their possessions throughout their lifetime while ensuring a smooth transition of these possessions to recipients upon their passing away, preventing the probate process and giving privacy to the household.

Charitable trust funds are additionally preferred for individuals looking to sustain a cause while keeping a stream of income for themselves or their recipients. Unique requirements counts on are crucial for people with handicaps to guarantee they get necessary care and support without endangering federal government benefits.

Recognizing the different sorts of trust funds offered for legacy planning is essential in creating an extensive method that lines up with individual goals and concerns.

Selecting the Right Trustee

In the world of legacy preparation, a critical facet that requires mindful factor to consider is the choice of a proper person to accomplish the crucial role of trustee. Choosing the appropriate trustee is a decision that can dramatically affect the effective execution of a trust fund and the fulfillment of the grantor's desires. When picking a trustee, it is important to focus on qualities such as reliability, financial acumen, honesty, and a commitment to acting in the very best passions of the recipients.

Preferably, the chosen trustee should possess a strong understanding of financial issues, can making sound investment choices, and have the ability to browse intricate lawful and tax needs. Effective interaction abilities, focus to detail, and a readiness to act impartially are also crucial attributes for a trustee to have. It is suggested to choose somebody that is reputable, responsible, and with the ability of fulfilling trust foundations the tasks and commitments related to the function of trustee. By very carefully taking into consideration these variables and picking a trustee who straightens with the values and purposes of the trust, you can assist make sure the long-lasting success and conservation of your tradition.

Tax Effects and Advantages

Taking into consideration the fiscal landscape bordering trust fund frameworks and estate preparation, it is extremely important to delve right into the elaborate world of tax implications and advantages - trust foundations. When establishing a count on, comprehending the tax obligation ramifications is important for enhancing the benefits and minimizing prospective obligations. Depends on use numerous tax benefits depending on their framework and purpose, such as decreasing estate tax obligations, income taxes, and present tax obligations

One significant benefit of particular depend on structures is the capability to transfer properties to recipients with decreased tax consequences. For instance, irrevocable counts on can remove assets why not try this out from the grantor's estate, potentially decreasing estate tax obligation liability. Furthermore, some depends on permit for earnings to be dispersed to beneficiaries, that may remain in lower tax obligation braces, leading to general tax financial savings for the family.

Nevertheless, it is necessary to keep in mind that tax obligation laws are intricate and conditional, highlighting the need of seeking advice from tax obligation specialists and estate planning professionals to make certain compliance and make best use of the tax advantages of trust fund foundations. Effectively browsing the tax obligation ramifications of depends on can result in considerable cost savings and a much more reliable transfer of wide range to future generations.

Steps to Developing a Count On

The first step in developing a trust fund is to clearly define the objective of the trust and the properties that will be consisted of. Next off, it is essential to select the type of count on that best straightens with your goals, whether it be a revocable trust fund, irrevocable count on, or living trust.

Verdict

To conclude, developing a trust fund foundation can give countless benefits for heritage planning, consisting of asset security, control over distribution, and tax benefits. By see picking the ideal kind of depend on and trustee, people can protect their assets and guarantee their wishes are lugged out according to their wishes. Understanding the tax ramifications and taking the required steps to establish a trust fund can assist strengthen your heritage for future generations.